Everyone has heard of a Last Will and Testament, most people know they need one, yet 60% of Homeowners still have not got around to putting one in place. Why?

If you do not have a valid Will at the time of your death, the Governments Intestacy laws dictate where your estate will go. Have you ever seen the TV programme Heir Hunters? It’s this law that in some cases enables a long distant relative to inherit your estate, even if you have never met them.

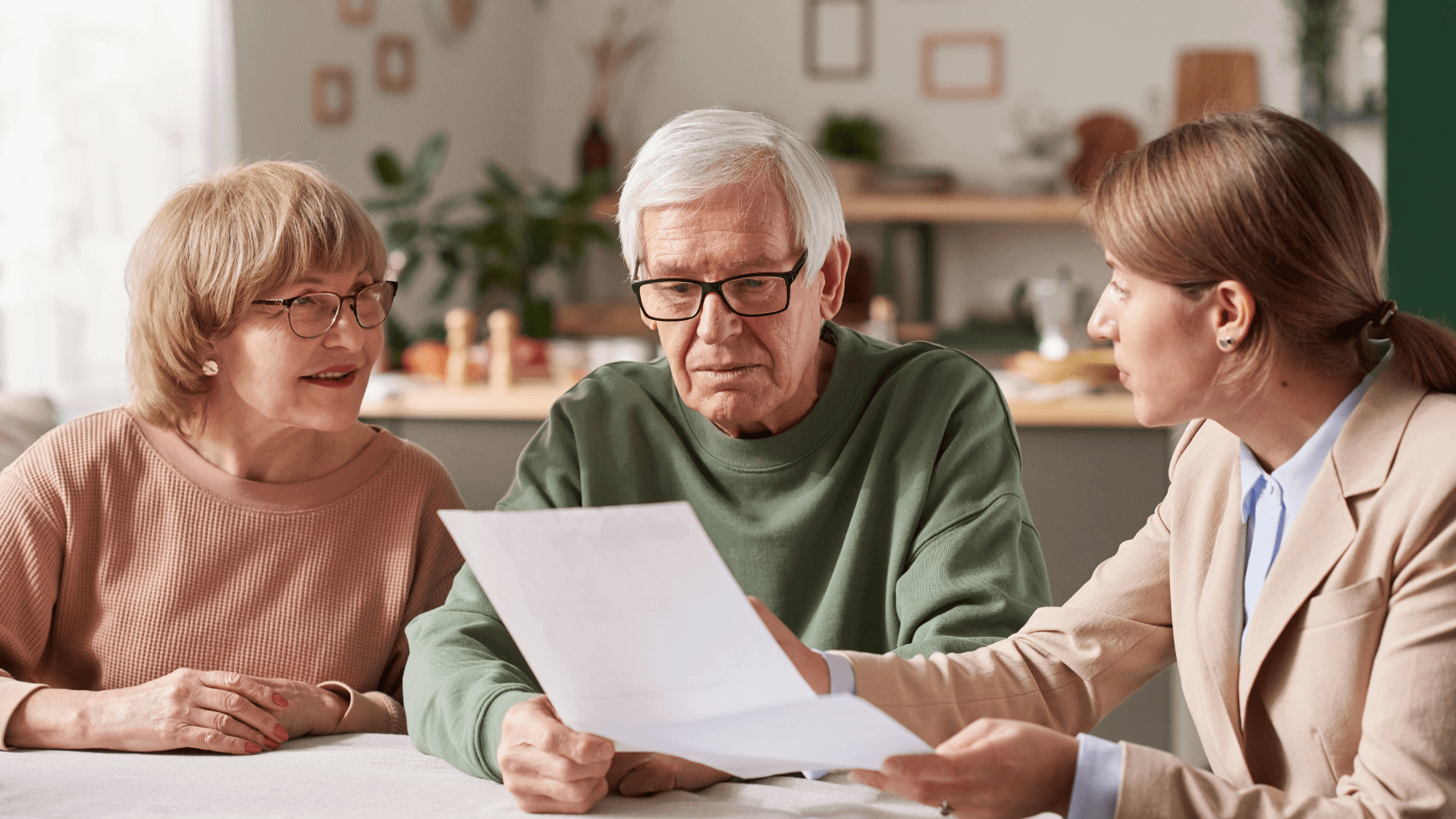

Dedicating 1 hour with our specially trained consultants can start the process, protect your decisions and ensure your estate passes exactly where you want it to go.

If you do not have a will in place when you pass :

The government uses Intestacy Laws to determine who will Inherit your estate.

You have no control on who will be guardians of any children under 18.

If you are unmarried, your partner will not inherit through intestacy laws.

You cannot exclude anyone form your estate without a will.

Any unclaimed money can legally pass to the treasury in time.

You might fall foul to the commorientes rule.

If you pass away without a will, you will be deemed to have died Intestate. The government have devised a flow chart on who should inherit in such circumstances. This is how, Heir Hunters, can locate distant cousins to inherit if applicable, even if they have never met you.

Naturally the parents of a child, unless designated otherwise by a court, will continue to become the legal guardians of your children if one of you passes. What happens if you both pass in an accident? If your children are under 18, they may find themselves under the care of social services whilst the matter of who will be the next legal guardian is sorted through the courts. This can be circumvented simply by writing a will.

If you are not married and you would like your partner to Inherit or to remain living in the house if you pass away before the asset passes to your children, you will need to write a will. Even if you have been together 30 years, with children together, Intestacy laws do not recognise a partner as someone who is entitle to inherit without a will in place.

Sometimes people who would expect to inherit, children, brothers or sister or even spouses, particularly in second marriages are not in your plans for whatever reason, be that you have not seen them for a significant period of time, the relationship has broken down or that you have already looked after them sufficiently whilst you are alive and wish others to inherit. These people should be officially excluded form inheriting and this can only be achieved with a will.

If you pass Intestate, the laws of Intestacy will apply. If there are no surviving relatives then under Bona Vacantia, your money will pass to the Crown. The Treasury Solicitor is then responsible for your money. Making a will, determines that your money will go where you wish it to go. If there are relatives and they have not claimed on an Estate in 12 years the same applies. Based on the accounts for the Crown Nominees for the year ending 2021, the previous 2 years saw a net income of over £100 million pounds flow to the Crown.

If you and your spouse were to have a simultaneous death such as a car accident and it couldn’t be deemed who died first, then it would be deemed to be the eldest. If you have children from a different relationship, it could mean the children miss out on the inheritance.

The Wills and Probate team at Centurion EPG provide expert guidance. Whether you are looking to write your Will for the first time or wish to update your existing Will, we understand how difficult this time can be and our estate planning team are here to put you at ease.

A Will puts you in control. You can choose who will benefit from your estate and what they are entitled to. You also decide who will administer your affairs after your death.

Another reason to have a Will is because it allows you to minimise your estate taxes. The value of what you give away to family members or charity will reduce the value of your estate when it’s time to pay estate taxes.

Unless you make a Will following your marriage, the rules of intestacy apply. This means that unless you have children, your surviving spouse will receive everything. If you have children, your spouse will receive the first £250,000 and half of the remainder of your estate.

If you and your spouse were to have a simultaneous death such as a car accident and it couldn’t be deemed who died first then then it would be deemed to be the eldest. If you have children from a different relationship it could mean the children miss out on the inheritance.

When you die your Will may be contested which shows the importance of having a Will written by professional.

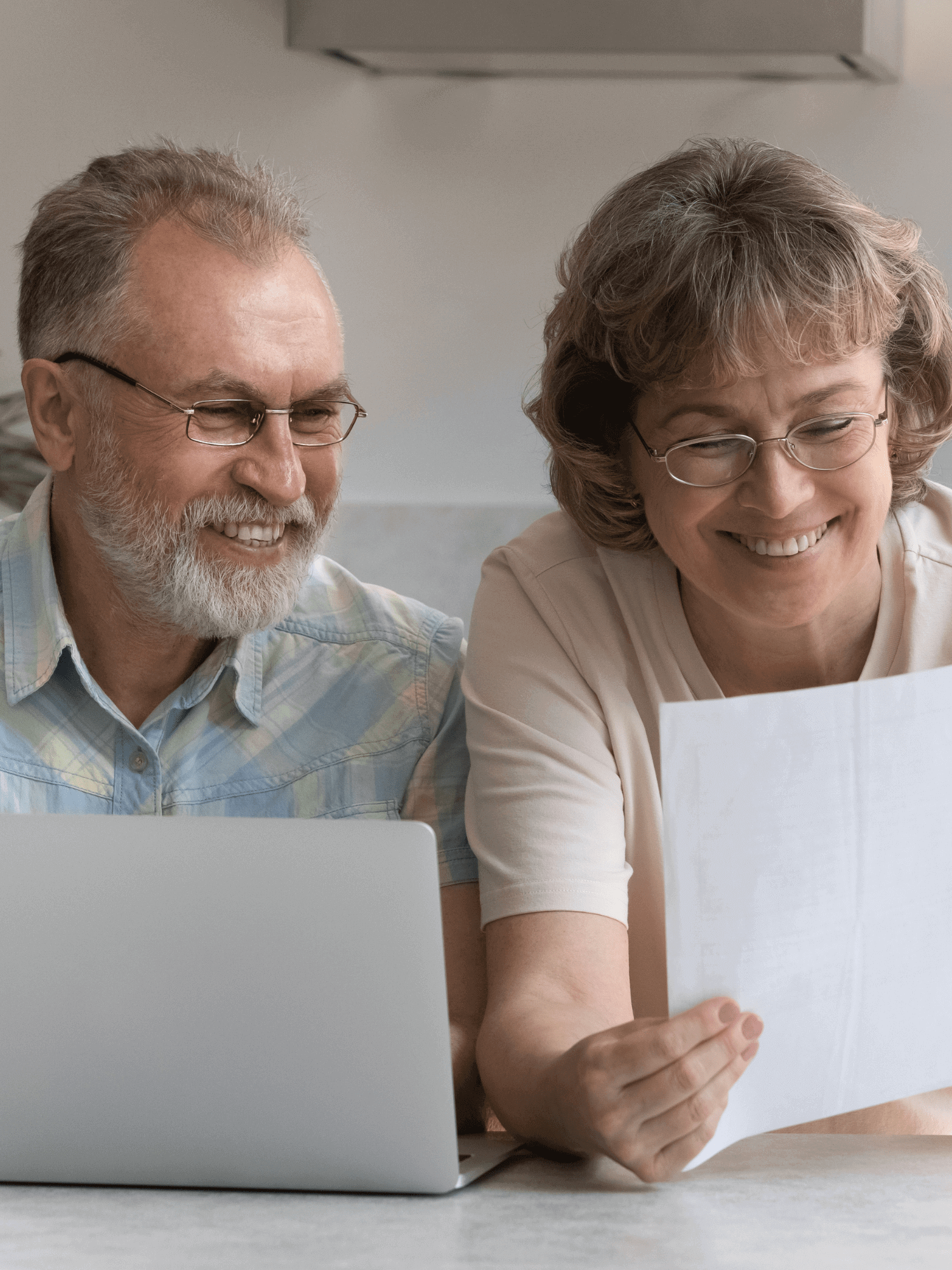

Writing a Will is one of those things that is so easy to put off, or one. that we do not want to think about doing. But once you've done it you will get a great peace of mind and a sense of relief.

Call us free on 0333 335 5472 or fill in the form below and one of our Estate Planning Experts will be in touch.